Article: Chinese Health Care Reform and the Medical Device Sector

I ran across another great article in Insight Magazine, which I thought I should share. Honestly I wish I could just write up every article from the journal because they are all really interesting (at least I think so…). Anyway, the piece was written by John P. Merritt, a consultant and 20- year veteran of the international medical device industry. Hope you find it as informative as I did!

—

Chinese Healthcare Reform and

the Medical Device Sector

The impact of China’s reform will have a significant impact on the rapidly advancing market for medical devices in China.

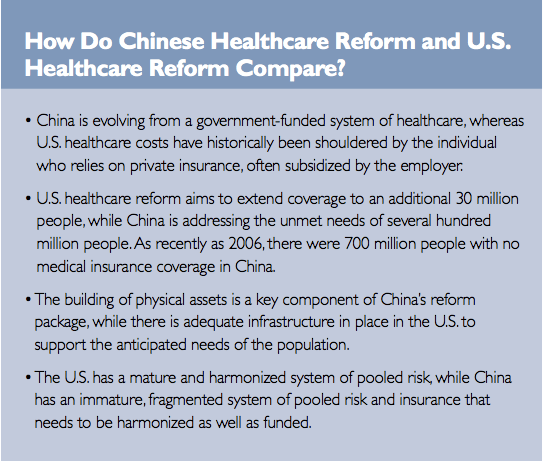

An important element of China’s 12th Five Year Plan is reforming the country’s healthcare system. With the objective of establishing basic healthcare coverage for 90 percent of its citizens by 2020, China’s healthcare reform, along with other elements of the 12th Five Year Plan, creates immediate opportunities for U.S. medical device manufacturers (MDMs). While China is more than capable of meeting local demand for low-end devices such as dressings, sponges, drapes and gowns, more than 80 percent of high-end medical devices, i.e. durable goods, equipment, implants and drug eluding stents, are imported. However, China’s healthcare reform plan also has the potential to strengthen the position of Chinese MDMs. To protect their position in the long run, U.S. companies must develop strategies designed to capitalize on the opportunities and navigate the challenges of this increasingly important and competitive market.

The global medical device market and China

The global medical device market is estimated to be valued at US$315 billion. In 2007, the U.S. accounted for 43 percent of the market, the E.U. accounted for 33 percent and Japan 10 percent of the total market. While China represented 20 percent of the world’s population at that time, it made up less than five percent of global demand for medical devices. However, for several years it has enjoyed double-digit growth and the market is expected to grow at 15 percent per year for the next 10 years. In January 2010, Liu Daozhi, vice president of Microport, a leading developer, manufacturer and marketer of medical devices in China, was quoted as saying “By 2020 [China] is expected to become the world’s second largest medical device market, valued at RMB360 million (US$52.71 million).” It is interesting to note that at present, there are more than 12,000 medical device manufacturers in China. But only 60 of these have sales valued at over US$14.6 million.

China has a large and established sector of companies manufacturing low-end devices. These low-end, or Class 1, products are manufactured for domestic consumption as well as for export, mostly under private labels for companies like J&J, Kimberly Clarke, Cardinal Healthcare and other major multinational MDMs.

On the other end of the spectrum, not only is China not a significant manufacturer or exporter of high-end, or Class 3 devices, most need to be imported to meet growing demand. Chinese generally prefer foreign goods when it comes to these products because those imported from America, Europe and Japan are perceived to be of higher quality. Since the leading producers of high-end medical devices are reluctant to move manufacturing to China due to intellectual property protection and enforcement concerns, they are imported.

Social and demographic backdrop to China’s healthcare reform

Social and demographic backdrop to China’s healthcare reform

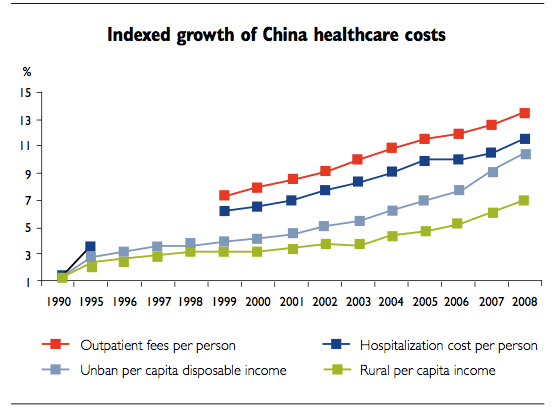

With the opening up of China and a gradual loosening of control and management of the healthcare sector, Chinese citizens have had to shoulder an increasing portion of their own medical expenses. In spite of the establishment of various insurance schemes and rising incomes, healthcare has become unaffordable for many and in 2006 it was estimated that there were 700 million people in China with no medical insurance coverage. Furthermore, while the urban areas benefited from China’s booming economy, the rural areas have been largely left behind. This has resulted in significant disparities between urban and rural areas when it comes to the quality and availability of medical facilities and services.

However, during this time, the need for expanded healthcare coverage in China has only increased. Today, China has 160 million people over 60 years of age, and by 2020 that number is expected to increase to 240 million people. As China ages and becomes more affluent, incidences of cancer are increasingly comparable to the Organization for Economic Co-operation and Development (OECD) average. Ischemic heart disease and stroke are notably higher; most likely due to a changing diet, hypertension and smoking, which is much more prevalent in China than other developed nations. In fact, the number of cardiac patients in China is growing at a 20–30 percent annual rate. Despite mounting health concerns, in 2009 China spent 4.3 percent of GDP on healthcare, less than half the average OECD average.

The lack of an effective healthcare system has had economic consequences as well. It has prompted Chinese citizens to save aggressively in order to pay for increasingly expensive healthcare services, a major obstacle to China’s goal of creating a more balanced, consumer-driven economy.

The basic elements of Chinese healthcare reform

China’s healthcare reform is intended to improve public health, bring rural healthcare more in line with the healthcare provided in urban areas and free up personal savings to drive consumption. To achieve these objectives, China has committed US$125 billion to be applied to two major fronts.

“Extending coverage to an additional 700 million people will most certainly increase demand for medical devices of all types.”

Funding and harmonization of insurance systems to reduce the number of uninsured in China

The multiple insurance systems currently in place will be harmonized and subsidies for insurance premiums for individuals will be provided. Prior to initiation of China’s healthcare reform, there were four social insurance programs in place covering different segments of society.

• Urban Employee Basic Medical (UEBMI) for the urban employed Insurance

• Urban Resident Basic Medical Insurance (URBMI) for urban residents without formal employment

• The New Rural Cooperative Medical Scheme (NRCMS) for the rural population

• Tax-financed medical assistance programs targeting the needy in both urban and rural areas

It is expected that as a result of reform under way, 90 percent of all urban and rural residents will be covered. Extending coverage to an additional 700 million people will most certainly increase demand for medical devices of all types.

Building of Infrastructure

In many regards, the basic assets or physical healthcare facilities in China are simply not in place to meet the above objectives. A key component of the government’s plan is to build or renovate some 3,000 hospitals and 29,000 clinics across China.

China is primarily served by a three-tiered system of public hospitals, augmented by private hospitals. Range of service, quality of care and products used can vary widely across the system. At the top of the public system are Tier 3 hospitals, with higher levels of service and care, as well as specialized capabilities. There are roughly 1,000 Tier 3 hospitals that offer general or comprehensive care. Tier 3 hospitals typically have more than 500 beds and they are more likely to offer premium-imported devices.

At the other extreme are the Tier 1 facilities, which are in some cases hardly more than clinics with extremely limited capabilities, operating on a township or village level serving rural areas. These are small facilities with limited capabilities, providing limited services and more inclined to use lower-cost, domestically produced devices. Many of these facilities have antiquated equipment and old inventories. There are approximately 12,500 Tier 1 hospitals. More and better Tier 1 facilities are needed if adequate healthcare is to be provided to rural areas, and this is a major component of the plan.

Tier 2 facilities, hospitals of medium size operating at the city, county or district level with between 100 and 500 beds, fall somewhere in between. There are more than 5,000 of these hospitals.

Reform will add a substantial number of beds to the system and dramatically increase demand for medical devices in China. China’s continued GDP growth and ageing demographic will also contribute to significant growth of the medical device market. Building this much infrastructure and harmonizing multiple insurance schemes across a country the size of China is quite an undertaking. However, China’s ability to put large scale infrastructure in place quickly and to develop strategic industrial sectors have been demonstrated more than once.

Looking forward

Chinese MDMs can expect to profit from increasing local demand for low end, or Class 1, devices due to an expanding base of hospitals and clinics. In addition, China will also see increased demand for these devices from the U.S. market as a result of U.S. healthcare reform, which will extend coverage to an additional 30 million people.

MDMs can expect to enjoy increased demand for Class 3 devices used in China where imported devices are preferred. But Chinese MDMs will also profit from increasing local demand for high end devices since there are hospitals less able to pay the premium required for imported devices. Furthermore, while servicing this increasing demand, a maturing, more innovative class of Chinese medical device manufacturers may well evolve that could challenge the leading device makers for market share in China and beyond.

This is particularly true where major MDMs seem to be complacent, relying on their superior technology and willing to concede the lower part of the Chinese market to local Chinese manufacturers. Their focus today is to simply compete against their traditional, mostly Western or international competitors for that sector of the market that is willing to pay a premium for superior goods. This is a dangerous strategy and can only be successful in the long run if the cost of upgrading quality to meet the demands of the China market drives up the price of Chinese devices to where they approach the price of imported devices. In many cases quite the opposite is more likely, since quality differences between imported Class 3 devices and locally produced devices are increasingly much less than the difference in selling price. This gap analysis is important since it implies that in some cases, Chinese MDMs could bring the quality of their high-end devices up to par while still keeping their price substantially lower than their international competitors, even if their price increased by 100 percent.

Also important for U.S. MDMs to consider is that a key component of the 12th Five Year Plan identifies seven Strategic Emerging industries (SEIs) that are of long-term strategic value to China. These industries will enjoy government support in the form of tax credits or other benefits. Medical Devices are considered a part of the biotechnology sector, one of the seven SEIs, which may impact the competitiveness of China’s MDMs and possibly the ability of foreign MDMs to access the China market.

At the same time, China is aggressively pushing for higher quality standards, more robust quality systems and more disciplined compliance in regulatory affairs. This should boost the real quality of Chinese-made devices and subsequently, increase the confidence of Chinese consumers in their own locally produced goods.

Given these factors, the migration of manufacturing to China for those Class 3 goods that have traditionally been imported is a strategy many foreign MDMs may have to consider if they are to compete against Chinese Class 3 device manufacturers who are expected to emerge and are increasingly offering comparable quality and performance with lower pricing.

Competitive response is needed

A rapid maturation of the Chinese medical device industry poses a threat to U.S. MDMs in the near term as well as in the long term. Leading MNCs manufacturing high-end medical devices would be best advised to look for ways to increase local content and to develop products specifically designed to meet the price performance needs of the Chinese market, or risk missing out on the opportunity to capitalize on this dynamic market and give the local Chinese competitors time to mature. In fact, by not competing aggressively in China, the leading multinational MDMs could find themselves competing against lower-priced Chinese goods in their respective home markets in the decades to come.

To respond to this competitive threat, U.S. MDMs could choose several courses of action:

• Development of product better tailored to the unique needs of the Chinese market, shedding unnecessary costs

• Utilization of local incubators such as Shanghai Institute for Minimally Invasive Technology, a unique government-funded incubator located in Shanghai

• Joint ventures with emerging Chinese firms where synergies exist

• Establishment of local manufacturing strategic acquisitions where possible

“China will be the most dynamic medical device market in the world for years to come.”

These are exciting times in the Chinese medical device marketplace. China will be the most dynamic medical device market in the world for years to come with significant opportunities and challenges. To take full advantage of the opportunities and to minimize the threats, an awareness and understanding of both are important, and the establishment of sound strategy in the near and long term is essential.